One of the most significant barriers to college completion is cost. For students who come from low-income backgrounds, the cost of college can seem impossible.

College affordability is a more significant barrier for Black and Latino students than for other students. Recent research shows that 49% of Black students and 36% of Latino students defaulted on their college loans at least once throughout 12 years, compared to only 21% of White students and 11% of Asian students. Black and Latino students also had higher college loan balances over time than other students. Black students owed an average of 113% of the amount initially borrowed after 12 years, and Latino students owe an average of 83% while White students owed just 65%.

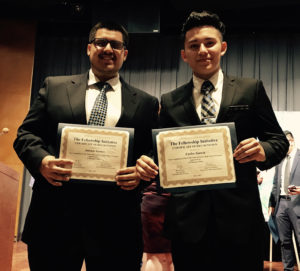

JPMorgan Chase and Bottom Line are working together to combat these barriers. JPMorgan Chase’s The Fellowship Initiative (TFI) is a program that supports the educational development of Black and Latino young men from low-income communities in Chicago, Dallas, Los Angeles, and New York City. As a college access and persistence organization, Bottom Line is well-positioned to support these young men in persisting through college.

One of the young men that Bottom Line and TFI are working with is Carlos Garcia Jr.

I am currently a sophomore at the University of Illinois at Chicago pursuing a Bachelor of Science degree in nursing with a goal of becoming a certified nursing assistant. I plan to pursue a career as a triage nurse and ultimately become a nurse practitioner. As a junior in high school, I volunteered at a hospital, shadowing different staff members throughout their day. Being in healthcare is a big deal because of the time and dedication the doctors and nurses put in to help the people they’re caring for. Their commitment is what influenced me to choose a career in healthcare.

Growing up in the Back of the Yards on the South Side of Chicago, I didn’t see college as an option for me. I never thought I would be going to college. I figured I would work after high school because few people in my community pursued a postsecondary degree.

In Back of the Yards, about 30 percent of its population lives below the poverty line, according to a 2013 analysis. The neighborhood is part of the New City community, where about a third of the population over 25 is without a high school diploma and half of the residents between the ages of 20 and 24 are unemployed.

I was able to look at the real world at a young age and saw what was going on in my community. I saw the violence that was occurring and didn’t want to live that life. I wasn’t the smartest student in the class, but I wanted to be different. I had a dream to fulfill my potential.

I attended Instituto Health Sciences Career Academy. The school may have lacked material resources (if a class had books, they were only used in class and returned immediately after), but it certainly excelled in building a motivating, involved, and influential community.

Athletics helped shape me into who I am today. I was the captain for both the Soccer and Track and Field team all four years. I’m thankful to my coaches for helping me develop my leadership skills through athletics. No matter what the outcome of the games or meets were, they were committed to supporting the team both as a group and individually. During my senior year of high school, I received the “Athlete of the Year” award. My coaches and teammates pushed me to do better every day, and they saw the potential I had to lead others. Being a captain helped with my communication skills and created lifelong bonds. I found my voice; I went from being quiet to being able to motivate and inspire my peers.

Track and Field team all four years. I’m thankful to my coaches for helping me develop my leadership skills through athletics. No matter what the outcome of the games or meets were, they were committed to supporting the team both as a group and individually. During my senior year of high school, I received the “Athlete of the Year” award. My coaches and teammates pushed me to do better every day, and they saw the potential I had to lead others. Being a captain helped with my communication skills and created lifelong bonds. I found my voice; I went from being quiet to being able to motivate and inspire my peers.

The community of peers and mentors at school helped motivate me to pursue college. My Math, Science, and Spanish teachers believed in me and always drove me to do better. Because of them, I became dedicated to my academics. When I was struggling in class, I went to them after school for help. I’m so grateful for the time that they dedicated to me. The people I met in high school brought out the best in me. I’m thankful for my guidance counselor for helping me find the path to where I am today. I owe a lot of my success to her because if she didn’t help me fill out my application for TFI, I wouldn’t have navigated my way to college. She helped me fill it out last minute and encouraged me to pursue higher education.

TFI changed my mindset; they helped make going to college a reality. Three Saturdays a month, I met with TFI. Being in a community of 40 Latino and Black young men who were all working toward the same goal made a huge impact. We spent the entire day focusing on strengthening our academic skills and learning about social justice issues, all connecting to how we could make a difference in our communities. When we started to get our acceptance letters, we cheered each other on because it was a huge accomplishment and it showed our hard work was paying off. Rudy Lozano, the current VP of The Fellowship Initiative, helped us speak up and find our voice. He changed each of us. With the support of TFI and the Chance Program, I was able to obtain a scholarship which is helping pay for school.

Since graduating from the TFI program, Carlos has gone back and works with the second cohort of TFI students. He now works with Rudy as a colleague. Rudy watched Carlos grow from a shy boy with a dream to a successful young man who is making it happen.

Since graduating from the TFI program, Carlos has gone back and works with the second cohort of TFI students. He now works with Rudy as a colleague. Rudy watched Carlos grow from a shy boy with a dream to a successful young man who is making it happen.

“TFI gave Carlos confidence. He’s always been determined but started off in a shy quiet way of doing that. Now, he’s much more willing and longing to get in front of others to inspire them. He has no limits in terms of his public speaking and getting in front of an audience to share his experiences and support students and their parents.”

Rudy worked closely with Carlos and his family during his time with TFI. While Carlos faced a lot of obstacles, “you wouldn’t know from him that he has just as many struggles and hardships as other students. He has a strength that allows him to persevere through any struggles that may be going on. He’s a leader in his home. He’s a leader in his family. He’s a leader in his community.”

Being a fellow with TFI has also given Carlos access to the Bottom Line program.

TFI connected me with Bottom Line which is helping me move forward with college. Jarred, my Bottom Line advisor is an older brother figure in my life. Jarred’s responsiveness lets me know he has my back. Instead of telling me what to do, Jarred gives me options and supports whatever decision I make. Jarred’s pep talks motivate me to keep trying, even when it seems impossible. With this type of communication, I am able to manage my life in college and plan accordingly.

I’ve seen many of my peers drop out of college. It’s hard because they don’t have someone to talk to the way I do. If something is going on, I can speak with Jarred.

“Carlos has been an inspiration to work with. Driven to succeed, he’s always aiming for the top. When things get challenging, I make sure we take the time to step back and look at the bigger picture. This gives us a chance to highlight his goals, anticipate the obstacles ahead, and plan accordingly. He’s taken an increasingly proactive role on campus and is beginning to distinguish himself as a leader among his peers. I see him continuing to grow into that role as he nears graduation,” said Jarred.

At one point I wasn’t going to be able to pay my tuition but Jarred worked with me to find a way to make it work. Education is expensive, and if it weren’t for Bottom Line’s help, I would probably be working more hours and possibly getting lower grades because the classes are just getting harder and I need more time studying.

I’ve been able to focus more on academics now that the stress of securing financial aid has been alleviated, and as a result, I’ve seen my GPA go from a 2.7 to a 3.2.

My community is my motivation for me to give it my all in college. I don’t want to let anyone down because everyone invested a lot in me. As a fellow, I’m grateful for the support that JPMorgan and Bottom Line offer me. If it weren’t for them, I wouldn’t be where I am today. I’m thankful for all the resources that both programs provided because it indeed can change the life of a young man.

The support of my parents also pushed me to succeed. Both of my parents are immigrants, and I’m the first one to go to college and the first one to be in this position. I want to make them proud.

Carlos is the oldest of three, and he hopes that his success will inspire his younger siblings to seek out similar opportunities to grow, learn, and succeed. His younger brother is now a member of TFI and is following in Carlos’ footsteps.

University of Illinois at Chicago, Class of 2022

University of Illinois at Chicago, Class of 2022